There are four different stages in a company's life cycle - What's the impact on financial analysis?

Hey there,

happy new year!! Have a great start into 2022.

Quick question: Is financial analysis boring? Is a due diligence boring? "A due diligence is boring because it’s always the same. It’s a standardized procedure. After you’ve done it ten times, you learned everything." That’s something, I hear from time to time.

Well…the process might be similar for most engagements. But — and this is important — the challenges and the aspects that are analyzed, are different for each project. Firms across different industries need different treatments and approaches. And so do firms across different stages in life cycles.

Today is about how financial analysis, and due diligence, need to adjust to the specifics of each stage of the life cycle.

|

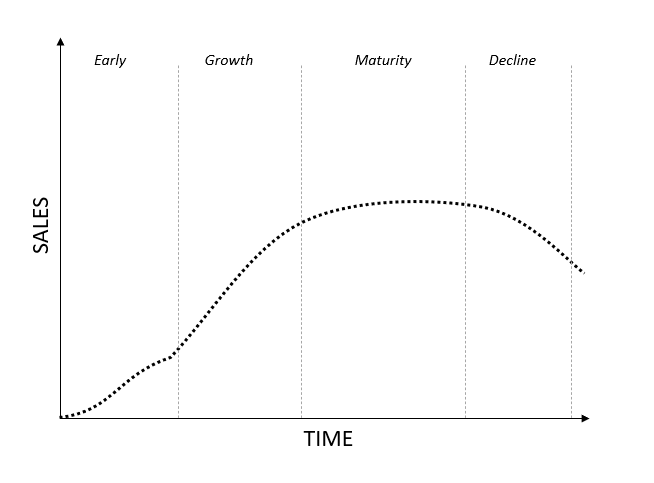

Literature typically differentiates between four stages. The early stage (or: launch stage, idea stage), the growth stage, maturity stage, and the decline stage. A firm in the decline stage can either reinvent itself and revive, be sold and integrated into another firm, or shut down. The chart above illustrates the common sales development.

Early-stage firms

Early-stage companies (startups) have low levels of revenue, if at all. Oftentimes, these firms encounter themselves in a thriving high-growth environment. The failure rate is high in the beginning. This makes the going concern assumption impossible, or at least challenging.

Challenges

Challenges relate to the lack of historical data. Given the early stage, there are often no historical financials. Also, projections are often difficult given the probability of failure. Financials are rarely very granular, it’s rather “top-line” and “bottom-line”.

Growth-stage firms

Firms in the growth stage are often characterized by dynamic financials. For example, a high earnings growth rate as well as higher margins. This is due to less competition in the niche market. Over time, competitors will enter the market. This will lead to lower revenue growth and a reduction in margins.

Challenges

Over time, competitors will enter the niche. Eventually, this will lead to lower earnings margins and lower revenue growth. Also, financials are often distorted. Margins can be too high because of no competition. Or margins can be too low because investments in further growth are recorded as expenses. If the firm is backed by private equity, financials can even be distorted by acquisitions, if it follows a buy-and-build strategy.

Mature firms

Mature firms grow at the market rate and exhibit steady levels of revenues and earnings. M&A activities are the main driver for growth. Internal transformation (efficiency projects, restructuring) is what improves margins.

Challenges

The organic and inorganic portions of the drivers of growth need to be identified. In a due diligence, a like-for-like comparison needs to be established. Also, the impact of the transformation projects needs to be quantified.

Declining firms

Declining firms typically show lower levels of revenue. These firms also exhibit lower earnings (margins). Declining firms are often targeted by turnaround investors. These investors focus on divested business units that need to be restructured.

Challenges

Analyzing these firms requires an understanding of the market and how it will develop. Is it the market that is in decline or this particular firm? This question helps understand the future of the company.

Key aspects

- Different stages across the life cycle require different angles

- While early-stage firms embrace the market potential and develop a competitive advantage, declining firms try to reinvent themselves and extend the life cycle.

FDD glossary

Have you already checked out the FDD glossary? If not, now's the time :) Check it out here.

As always, feel free to reach out if you have any questions.

Cheers,

Jan

Hi, I’m a creator

Hey there, I hope you are doing great. This is the third part of our working capital analysis. Trade working capital consists of inventories, trade receivables, and trade payables. Other items could also be classified as trade working capital. This is dependent on the company’s specific business model. The main goal is to understand what drives trade working capital and how it developed over time. There are several main analyses that you should conduct. Monthly working capital analysis...

Hey there, I hope you are doing great. A number is not always a number - that's the title of this insight. Much of my content circles around running certain analyses and asking questions. But let’s step away from the numbers for one moment. As important as being able to analyze the numbers is to understand where these numbers come from. In due diligence reports, this is often called the “quality of financial information”. This section assesses the quality of the data. It also shows...

Hey there, in the course of a due diligence, it is important to understand capex. This is the last step in the cash flow calculation to derive the free cash flow. The free cash flow is used in many valuation models to calculate the value of a firm. Capex stands for capital expenditure. It relates to investments into fixed assets, i.e. tangible and intangible assets. Two aspects matter in a due diligence. First, what’s the recurring level? And second, which portion relates to maintenance and...