Will you sustain it? Is the past comparable to the future?

Hey there,

whether you are an entrepreneur or not, I want you to be prepared when it comes to the discussion about the sustainable growth of your firm.

I’ve been doing mainly financial due diligence. So, I have been analyzing firms from a financial standpoint for the last years. Large companies as well as small firms and startups. Most due diligence assignments cover this topic: corroborate a company’s business plan. The validation can be done from a commercial or financial perspective. For the latter, the validation of future growth is quantitatively driven. For example: is there an explanation for these figures? How do they tie back to historical financials? Yet, there is no guarantee that growth will come as modeled.

Today, I am sharing my thoughts about a company’s growth. It’s no recipe or guide on how to approach an engagement, it is rather a collection of thoughts to keep in mind.

Top-line vs. bottom-line

It is important to differentiate between top-line and bottom-line growth. And everything that happens between top and bottom. Fixed costs can grow at a lower stage compared to revenue and to their fixed nature. Revenue can grow at a slower rate compared to EBIT(DA). For example, if the drivers are internal efficiency improvements. That way, the company increases its EBIT(DA) by reducing its costs. So, determining which growth rates to use for which line items is already an important first step.

Historical data

How many years are we looking at? In a due diligence, the last three to five years are analyzed. Is this enough to make meaningful statements about a company’s future growth? It depends on the company, the industry and the business model. Taking into account the availability of data is also important.

Life cycle consideration

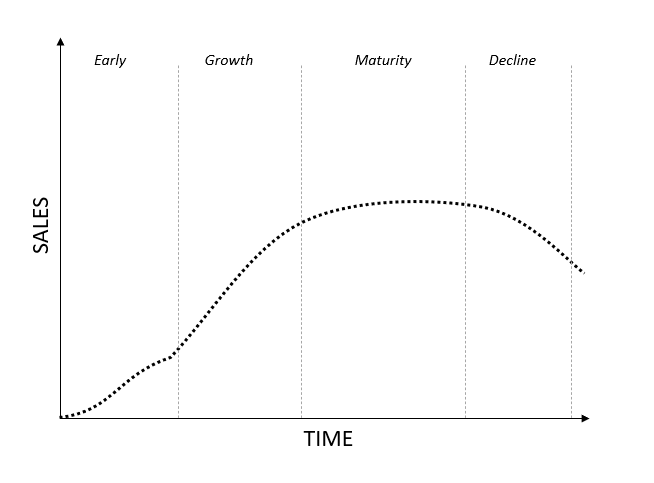

|

own creation by the author

This chart shows the different stages. And it also shows that growth depends on the company’s current stage. It is important that we understand the company’s stage. And also, to which extent this will change within the next years. For example, growth rates will likely decline for early and growth firms. But they will be stable for mature firms and negative for firms in the decline.

Industry matters

Each industry has its own drivers. Cyclical industries follow a “high growth — low growth” pattern, ups and downs.

Project-based businesses (construction, consulting firms, automotive suppliers) often follow the order book. The order book is the pipeline with future projects. It provides good visibility of how the company will do in the next year.

Key aspects

- Differentiate between top-line and bottom-line

- Take into account that your data set is limited

- Consider the current stage of a company’s life cycle

- Have a look at the company’s specific industry

Final thoughts

What do you think? What's important about growth? Which aspects do or would you consider?

Looking forward to seeing your thoughts.

Cheers,

Jan

Hi, I’m a creator

Hey there, I hope you are doing great. This is the third part of our working capital analysis. Trade working capital consists of inventories, trade receivables, and trade payables. Other items could also be classified as trade working capital. This is dependent on the company’s specific business model. The main goal is to understand what drives trade working capital and how it developed over time. There are several main analyses that you should conduct. Monthly working capital analysis...

Hey there, I hope you are doing great. A number is not always a number - that's the title of this insight. Much of my content circles around running certain analyses and asking questions. But let’s step away from the numbers for one moment. As important as being able to analyze the numbers is to understand where these numbers come from. In due diligence reports, this is often called the “quality of financial information”. This section assesses the quality of the data. It also shows...

Hey there, in the course of a due diligence, it is important to understand capex. This is the last step in the cash flow calculation to derive the free cash flow. The free cash flow is used in many valuation models to calculate the value of a firm. Capex stands for capital expenditure. It relates to investments into fixed assets, i.e. tangible and intangible assets. Two aspects matter in a due diligence. First, what’s the recurring level? And second, which portion relates to maintenance and...